Vegan Pensions, the Next Ethical Frontier

THE CASE THAT RATTLED THE PENSION INDUSTRY

In 2020, I won a lawsuit that led an employment judge to rule that ethical veganism is a protected class in Great Britain. A week later, I read this headline on a leading financial website called the FT Adviser: Landmark vegan case threatens to disrupt pensions industry. It seems that my victory opened the door for the spread of the long-awaited vegan pension. Finally, vegans can enjoy their retirement plans knowing that their money does not come from exploiting animals.

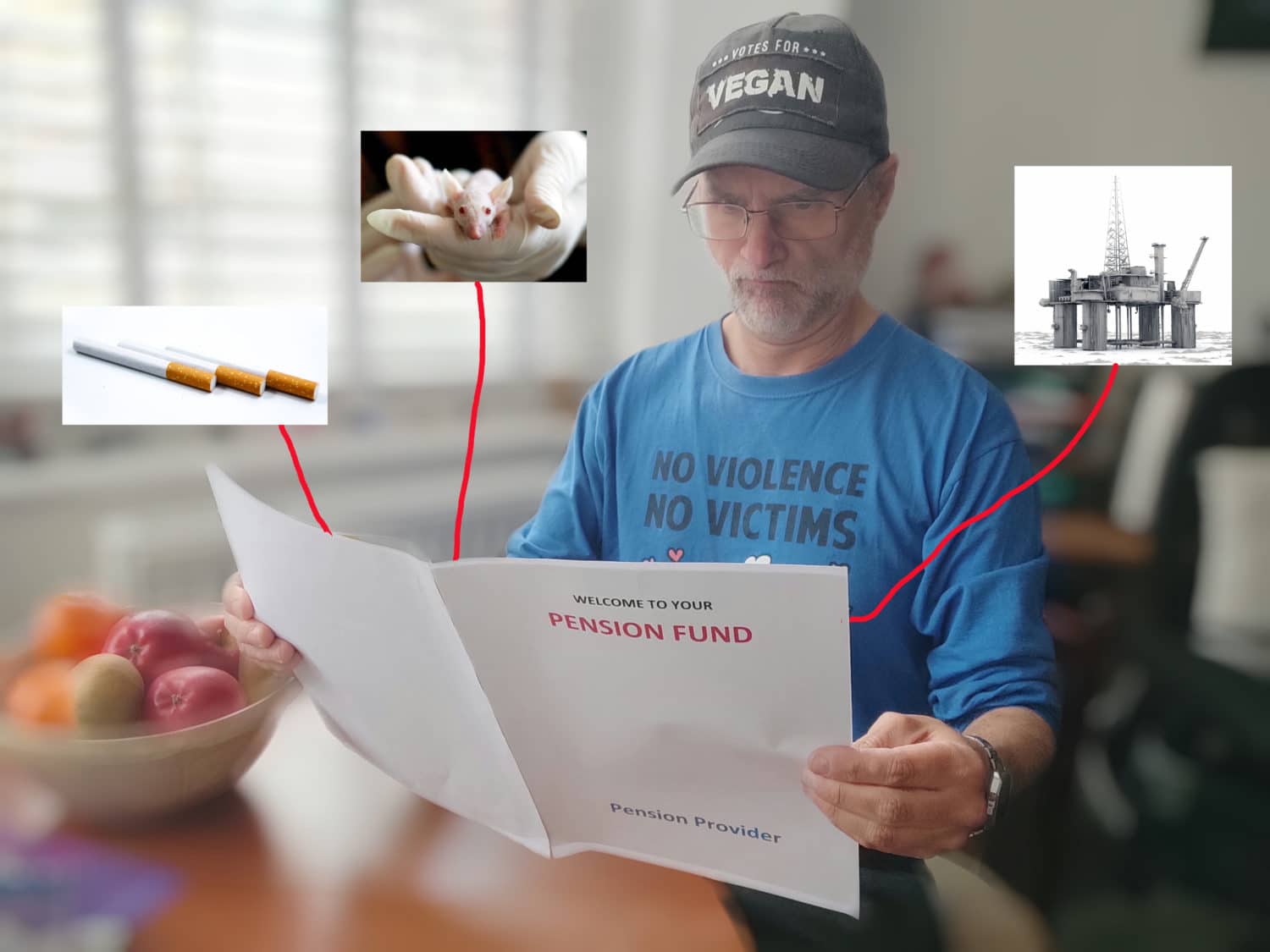

My case started when an animal protection organization fired me for having raised concerns about their pension fund. I considered the fund unethical for a vegan like me as it invested in pharmaceutical companies that test on animals. I knew that there were ethical funds available from the organization’s pension provider. Such funds, although not necessarily completely vegan, were vegan friendlier, as they avoided investments such as pharmaceuticals. Because of my complaint and ultimate legal victory, my former employer has now changed its default pension fund to one of these.

THE BIRTH OF VEGAN PENSIONS

Ethical pension funds are also known as ESG funds, which stands for Environmental, Social and Governance. These are the three key factors measuring the sustainability and ethical impact of an investment in a business or company. Environmental criteria include waste, pollution, resource depletion, greenhouse gas emissions, deforestation, and climate change. Adding animal welfare issues to this list would move them towards becoming vegan pensions. The outcome of my legal case may encourage ESG pension providers to do this now.

There are already vegan pension funds that have been available in some jurisdictions for quite some time. The vegan financial planner Lee Coates OBE (Order of the British Empire) was one of the pioneers of this. He has run Ethical Investors since 1989 and established the first vegan investment funds in the UK in 1992. Later, in 2010, he launched the vegan pension fund Cruelty Free Super in Australia. In a podcast, he told Katrina Fox, from Vegan Business Media, the following:

“Back in 1989, a lot of people had never heard about ethical investment. They never made that connection that their money made bad things. And, of the financial products available (there were quite a few in the UK), none of them tackled animal welfare issues. So, it took me two and a half years of hard negotiations with a couple of UK ethical funds to get them to go vegan.”

“AFTER HAVING SPENT QUITE A BIT OF TIME TRYING FOR THAT TO HAPPEN, THREE FUNDS WENT VEGAN IN THE SAME YEAR.”

ESG funds are doing very well in Europe. Last week, Morningstar published that 51% of overall European fund flows are now heading to ESG products. They are now approaching $2 trillion of investment.

VEGAN PENSIONS ARE NOT INHERENTLY RISKIER

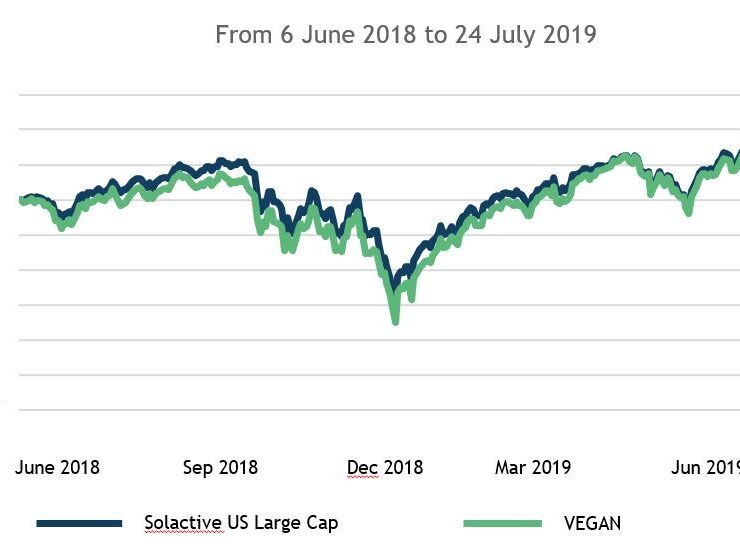

According to S&P Global, there is mounting evidence that many ESG-focused funds beat the overall market amid Covid-19 shutdowns. This is true despite the popular belief that investing in such funds fails to maximize returns. Research by Moneyfacts has uncovered that, over the course of 2020, the average ethical fund has produced returns of 4.3%.

Claire Smith is the founder and CEO of Beyond Investing and adviser to the vegan-friendly exchange-traded fund VEGN ETF. She told me she agrees with this assessment as I interviewed her for another article on vegan stocks. I explained to her that my former employer might have chosen a non-ethical fund because of the belief in possible higher returns. She replied: “I don’t think this argument actually stacks up anymore. It’s has been shown, over a long period of time now, that the ethical funds actually outperform the non-ethical funds.”

Claire’s company tracks the US Vegan Climate Index, which has recently outperformed the S&P500 (the index that covers 500 of the largest US companies). In 2020, the vegan ETF VEGN delivered a return of 27.69%. Not too shabby, to put it mildly.

Lee Coates agrees that ethical funds are not riskier. In the same podcast, he says: “The reality is that there is no difference between the returns in ethical funds and mainstream funds. The average ethical fund will do the same as the average non-ethical fund. But the perception is that being good will come at a premium. Because in almost every other aspect of your life (buying fair trade, buying vegan products) you are used to paying a premium.” He adds…

“THE PERCEIVED PREMIUM IN THE FINANCIAL PRODUCTS IS THAT EITHER THERE ARE SPECIAL VEGAN PRODUCTS THAT COST A LOT MORE, OR THAT THE COST IS ‘I WOULD MAKE LESS’ AND THAT IS JUST WRONG.”

VEGANS SHOULD CHECK THEIR PENSION FUND LIKE THEY CHECK FOOD LABELS

As a vegan, I always read the labels of the products I buy to ensure they are suitable for me. But having been vegan for almost twenty years now, I have learned to check more than just food and clothes labels. I check all products and services, including financial ones. This is how I found out that the pension fund my former employer enrolled me in was not ethical enough for me. However, most ethical vegans I know don’t do that, and I think they should.

Many do discover, like me, that a percentage of their salaries goes to animal exploitation through their pensions. However, many still don’t change them, even if they easily could. I think this is quite inconsistent with the vegan philosophy. As Lee Coates puts it…

“The average vegan going to the supermarkets isn’t going down the aisle where the vegan products are, saying, ‘Those vegan sausages look a bit expensive. It’s a bit of a risk spending a lot of my money on those. I think I will eat meat this week.’ But, on the other hand, they can sit there quite calmly looking at an ethical investment and go, ‘If it doesn’t make me as much money, there is a risk. There is a cost element. I think I’ll invest unethically in meat because I can’t afford not to.’”

IF WE ALL TELL OUR PENSION PROVIDERS/EMPLOYERS THAT WE WANT VEGAN PENSIONS, WE WILL INDEED REVOLUTIONIZE THE PENSION INDUSTRY. WE WILL CUT SIGNIFICANTLY THE FUNDS GOING TO ANIMAL EXPLOITATION. PERHAPS MORE THAN BY JUST BUYING PLANT-BASED FOOD IN A SUPERMARKET. LOTS TO WIN, AND VERY LITTLE TO LOSE.

JaneUnChained News does not offer financial advice. This article is for the purposes of providing an overview only and is not a recommendation of any specific stocks or funds.

What's Your Reaction?

Jordi Casmitjana is a vegan zoologist and author.